Mega Backdoor Roth Amount 2025. The regular 401(k) contribution for 2025 is. How does this add up?

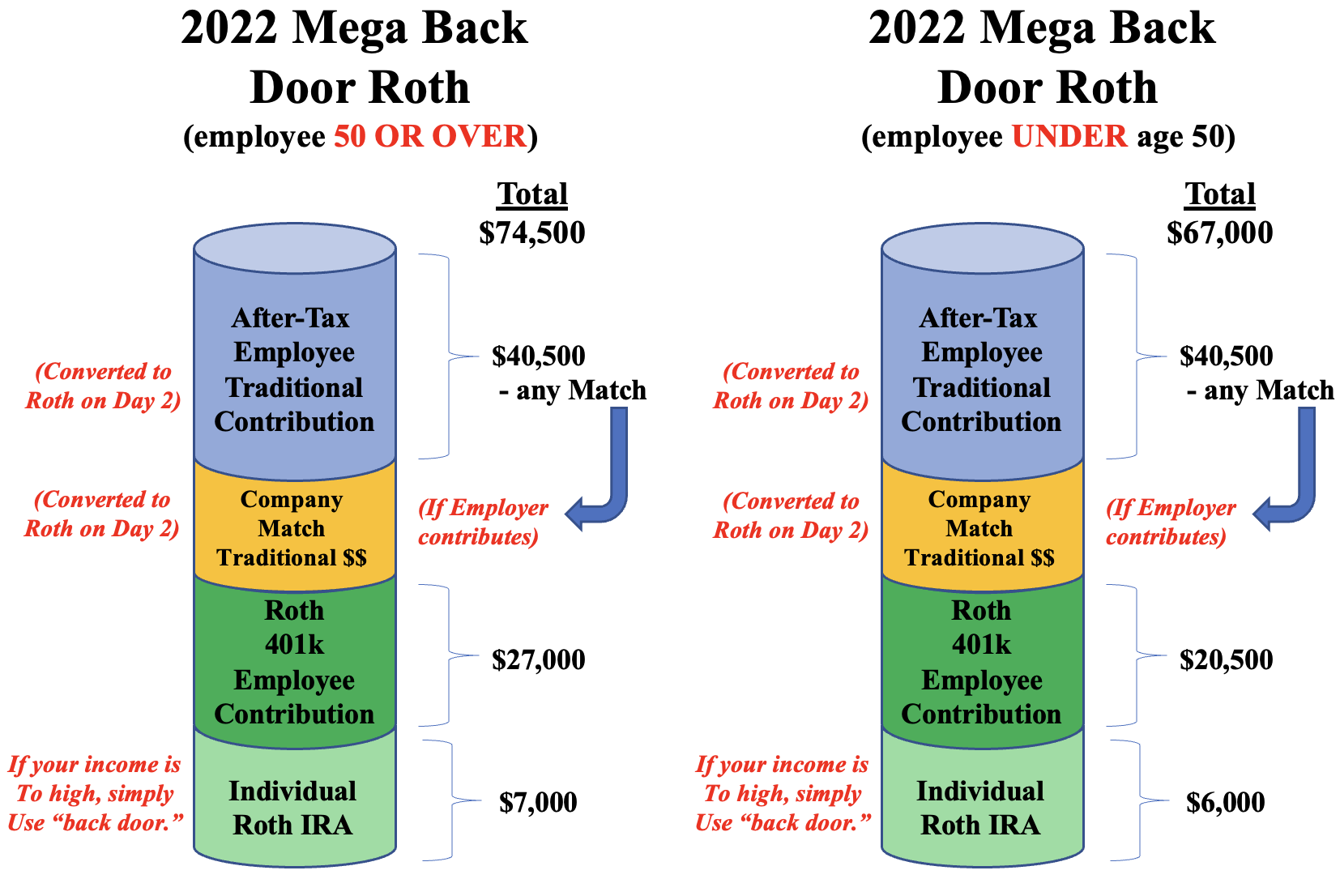

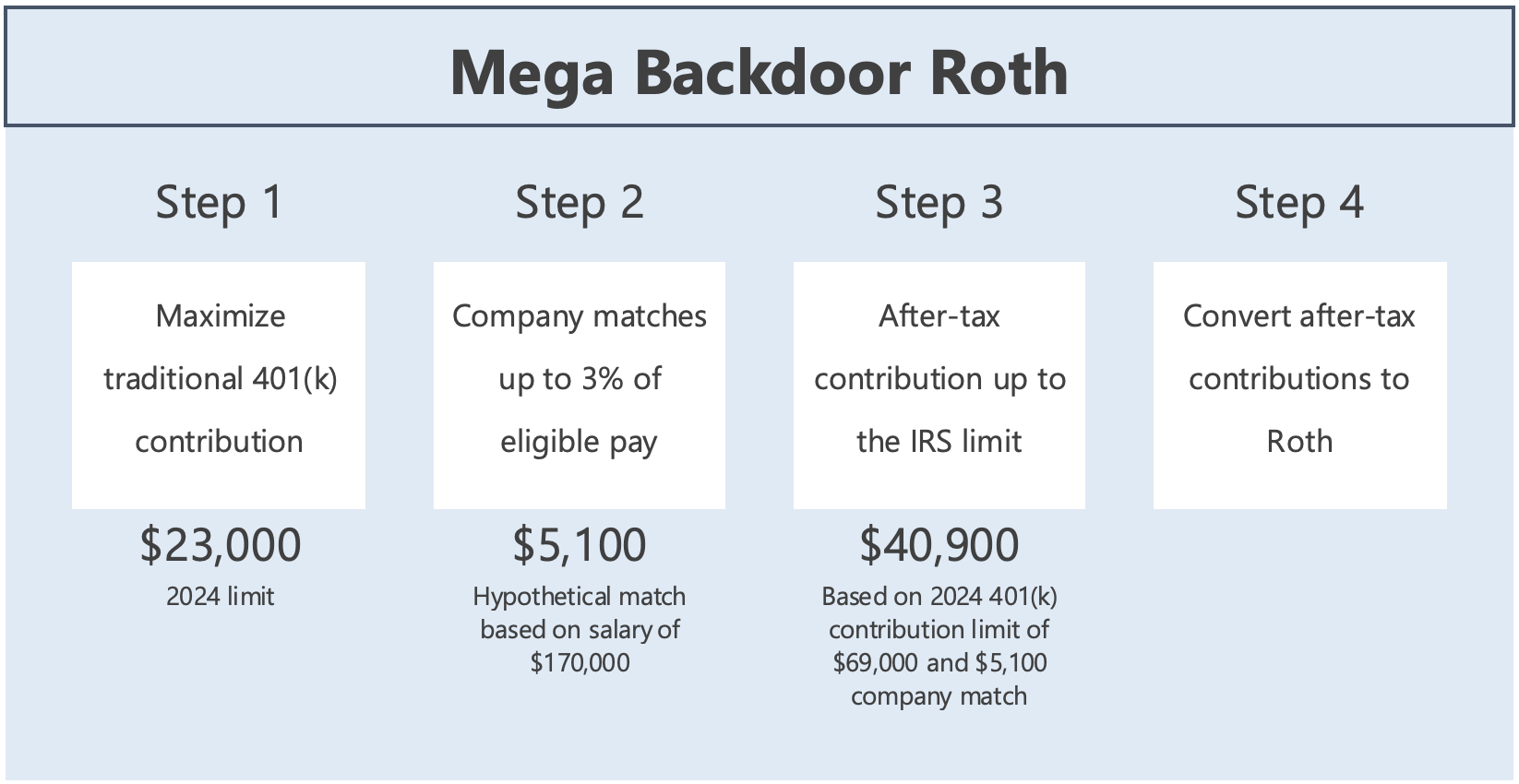

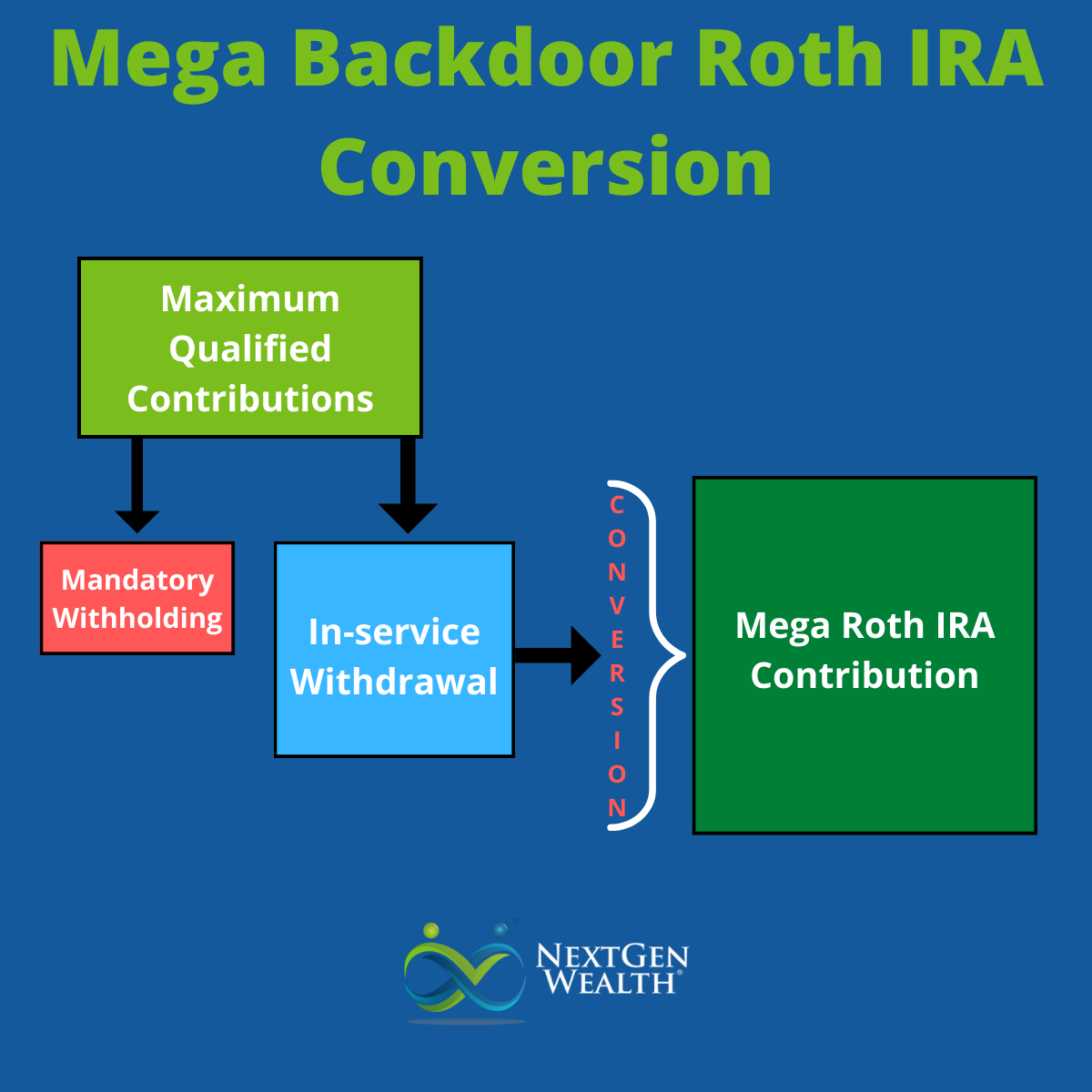

Commonly called a backdoor roth conversion, this technique involves the taxpayer moving funds from an existing traditional retirement account to a roth and paying income tax on. The resulting maximum mega backdoor roth ira contribution for 2025 is $46,000, up from $43,500 in 2025 if your employer makes no 401(k) contributions on your behalf.

What is the Meta Mega Backdoor Roth? Avier Wealth Advisors, If your employer matched any of your yearly contributions, your mega.

Mega Backdoor Roth Limit 2025 Corri Doralin, The mega backdoor roth limit for 2025 is expected to be $58,000 for individuals under the age of 50 and $64,500 for those 50 and older.

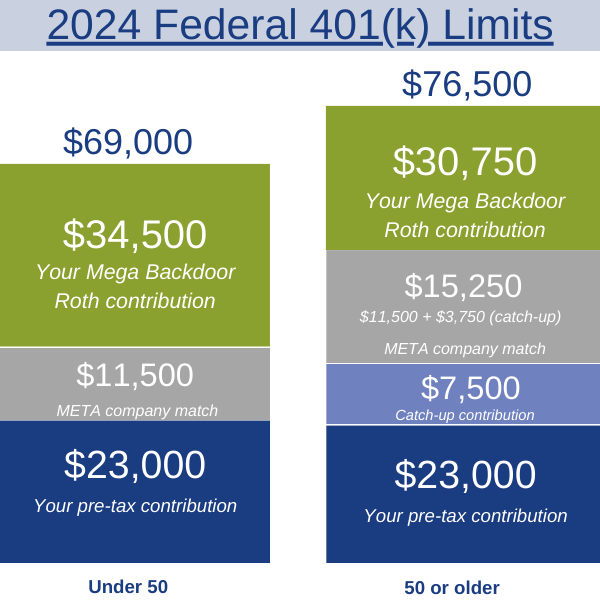

Mega Backdoor Roth NESA, The mega backdoor roth allows you to save a maximum of $69,000 in your 401(k) in 2025.

Mega Backdoor Roth Maximum 2025 Janis Rebecca, What is a mega backdoor roth conversion (aka after tax to roth conversion)?

How Does A Mega Backdoor Roth Work? 2025 Update!, In 2025, the total dollars allowable into a 401(k) is $69,000 if you’re under 50 and $76,500 if you’re 50 or older.

2025 Mega Backdoor Roth (69k Into Retirement) StepByStep How To, How does the microsoft 401(k) and mega backdoor roth work?

MegaBackdoor Roth Guide (2025 Update!) + Flowchart, The resulting maximum mega backdoor roth ira contribution for 2025 is $46,000, up from $43,500 in 2025 if your employer makes no 401(k) contributions on your behalf.

Mega Backdoor Roth Definition & How It Works Seeking Alpha, What is a mega backdoor roth conversion (aka after tax to roth conversion)?